The Acquisition

Berbix was founded in 2018 by former members of the Airbnb Trust and Safety team to redefine best-in-class document verification. Their solution incorporated a powerful forensics and hyper accurate data extract engine, with an emphasis on both the human and machine-readable components of an ID (OCRs, MRZs, barcodes), resulting in unmatched accuracy, unparalleled user experience, and the lowest number of false rejects on the market. And this was achieved exclusively with provided documents and user selfies without looking at external data sources.

Launching its Document Verification in 2019, Socure built a best-in-class capture experience and paired that with predictive fraud analytics models that leveraged its identity graph, PII, and device-related data to become the first fraud and risk predictive document verification solution in the market.

Now Socure's Document Verification 3.0 cleanly integrates the Berbix forensics engine with Socure's capture experience and predictive capabilities, resulting in a document verification solution that leads the market in true accepts, true rejects, fraud capture, and speed.

Founded in 2018, Berbix helped 100+ customers solve for use cases in fintech, marketplace, crypto, micromobility, telehealth, gaming, employment, and more.

Accuracy

Up to 26% lift over competitors in accepting good submissions on

the first try

Fraud Capture

Up to 27% lift in fraud capture relative to major competitors

User Experience

<4 second response times for all documents

Global Document Coverage

Less than 5 days to onboard a new document

What this means for Socure customers

Socure customers are already experiencing boosted performance metrics from the integration of Berbix technology into the Socure DocV solution.

The new DocV 3.0 platform boasts advancements in both our forensic analysis engine and in data extraction, both of which promise enhanced auto-acceptance rates, more accurate fraud detection, and a significant reduction in transaction latency.

What this means for Berbix customers

Existing Berbix customers will soon have the opportunity to migrate to Socure’s Predictive Document Verification (DocV) platform where they will have access to enhanced performance, the world-class Capture App, and the robust identity graph of the best PII and device-related capabilities.

Existing Berbix customers can also take advantage of Socure’s full suite of fraud and compliance solutions. The Socure customer success team will reach out soon with next steps for migrating.

What is Predictive Document Verification?

Predictive Document Verification (DocV) verifies a customer’s government-issued ID, such as a driver’s license, passport, or photo ID card, against their facial biometrics, approving more good customers while eliminating bad actors in real time. The superior capture experience, powerful forensic engine and hyper accurate data extraction drastically increases confidence that you’re checking a valid identity.

When this powerful capability of validating a government-issued photo ID is paired with predictive risk signals from the world’s most comprehensive identity graph, the result is a solution that changes the state-of-the-art of identity verification. With the fastest, most accurate, and most conclusive results, you can feel confident onboarding, verifying and reverifying your users.

DocV 3.0: Greater than the sum of the parts

The combined strength of Berbix and Socure is reflected in the unmatched accuracy metrics of DocV 3.0, the latest version of our Predictive Document Verification solution.

Unmatched Accuracy

Highest rate of true accepts and true rejects

- First-time acceptance of good submissions improved by 26% – DocV 3.0 delivers 90% of fully automated decisioning results vs. an industry standard of 64%

- First-time rejections of fraudulent submissions improved by 27% – DocV 3.0 delivers a 83% first attempt auto approval rate of good consumers vs. an industry standard of 56%

Sophisticated Fraud Prediction

Patent-pending fake ID detection and powerful machine learning models

- World-class fraud detection models catch sophisticated bad actors using a combination of computer vision and comprehensive identity graph data

- Powerful forensics and data extract engine extracts hyper accurate data from the human and machine-readable components of an ID (OCRs, MRZs, barcodes)

- Image alert list tracks when the same headshot is used across multiple document verification transactions when certain other signals of fraud are present, such as different PII or age discrepancy

Rapid Decisioning

Industry-leading response time

- Competitor response times averaging 6 to 75 seconds

- Faster response times mean quicker decisions and lower abandonment rates

Superior UX

Inclusive and accessible design

- 94% conclusive results on the first try (14% more than the industry norm of 80%) maximizes accuracy and minimizes retries

- 100% automated solution provides consistent, fast results

- Machine-driven decisioning for reducing bias and accessibility features for visually impaired users

- Instant processing of images with real-time guidance throughout the entire identity verification process

Global Coverage

Global document coverage with fast onboarding of new IDs

- Global coverage of ICAO-compliant travel documents, passports and national ID cards

- New ID document onboarding in less than 5 days

Holistic View of Identity

Predict more risk with identity graphs and AI and machine learning

- As a part of Socure’s Risk Insights Network with robust identity graphs and the best PII and device-related capabilities, DocV delivers contextual clues as to who is behind each transaction. This IAL2-compliant solution provides a holistic view of identity, with the flexibility to adapt to quickly developing use cases.

Events

The Future of Document Verification

Watch our webinar to learn about accelerating markets in the document verification space, the evolving technology needs in a post-COVID world, the crucial role of providing global document coverage for solutions that are accurate and flexible, and future predictions from industry experts.

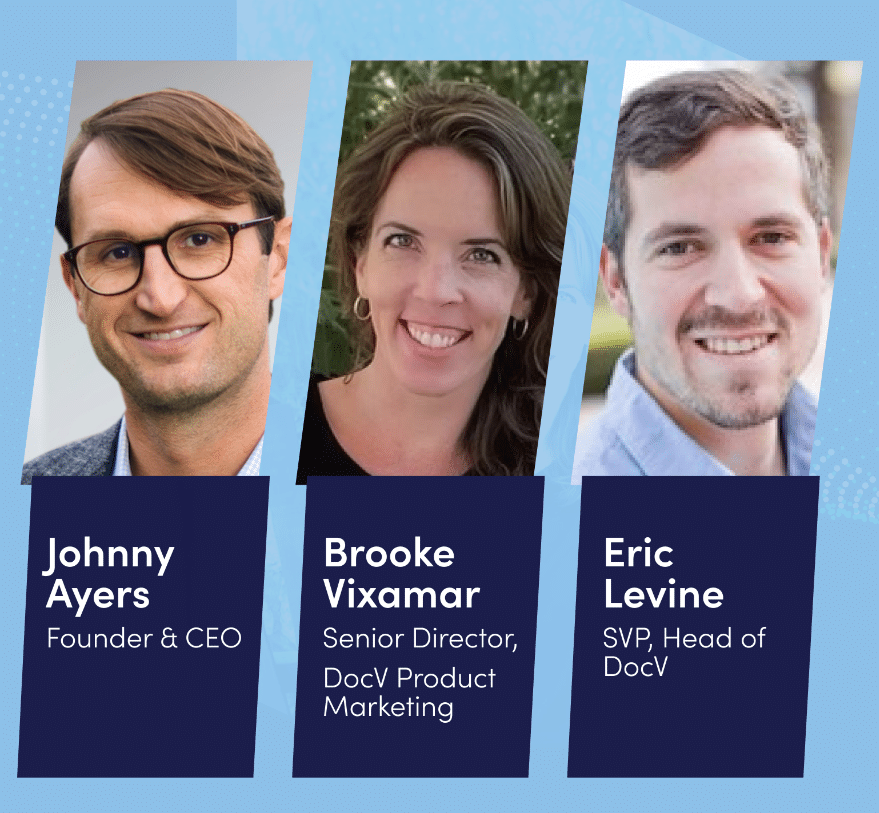

Revolutionizing the Document Verification Market

Watch Socure founder and CEO, Johnny Ayers, and Berbix founder, Eric Levine, in a 15-minute discussion on the ins and outs of Socure’s acquisition of Berbix.